You are planning for your financial retirement. You want to retire at 60. You plan to have an endowment fund that will give you a monthly income of RM 10,000 per month after retirement: Financial Management Assignment, UTP, Malaysia

| University | Universiti Teknologi PETRONAS (UTP) |

| Subject | Financial Management |

Question 1 :

You are planning for your financial retirement. You want to retire at 60. You plan to have an endowment fund that will give you a monthly income of RM 10,000 per month after retirement.

You think you can do it by contributing to the Employees Provident Fund (EPF) and earn about 6% per annum.

Required :

- Determine how much endowment fund you need at retirement point to earn the RM 10,000 per month, assuming EPF will continue declaring a 6% dividend per annum.

- Determine how much saving per month that you need to make over the 30 years to meet the target endowment fund ?

- What will be the challenge in achieving the above target ?

Question 2 :

You felt that the above retirement program may be very hard to achieve as your monthly income is not sufficient to contribute the required monthly investment installment.

So you are going for a creative approach in generating the retirement fund using the business and entrepreneurship approach. Using the wealth magnification approach is seen as a more credible route.

The approach is as follow :

- To identify a product and business opportunity

- To start a pilot business operation using the cheapest and simplest form

- To magnify business volume by opening more outlets or branches.

- To magnify wealth using the Market earning multiple approach

- To target corporate listing within the next 5 – 10 years

- To guestimate the target value of wealth that can be generated within the next 15 years.

Show you spread sheet analysis. If you use time value of money in the opportunity analysis, will this approach still stand viable?

Question 3 :

A Feasibility study of Photovoltaic Solar Power Plant

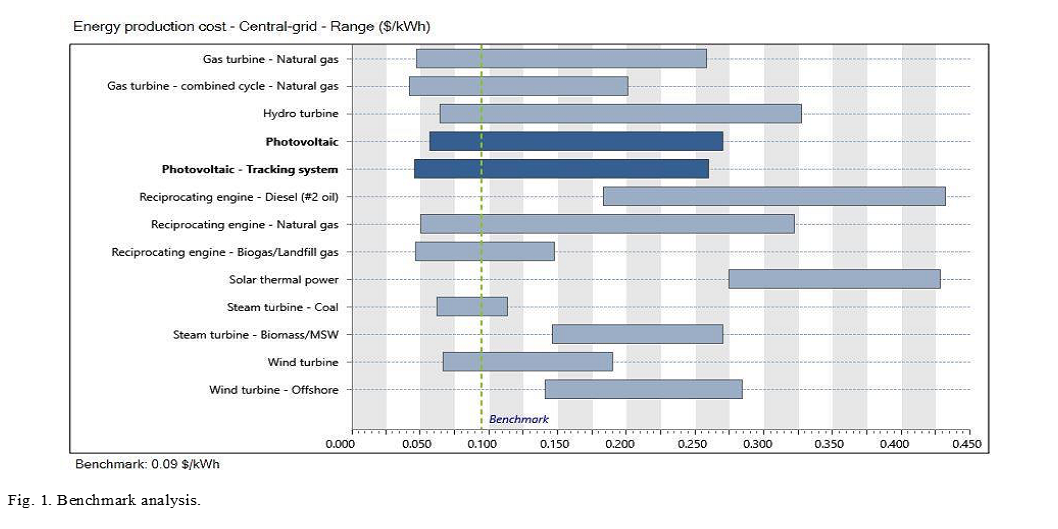

Benchmark analysis of Energy production costs

Energy Analysis

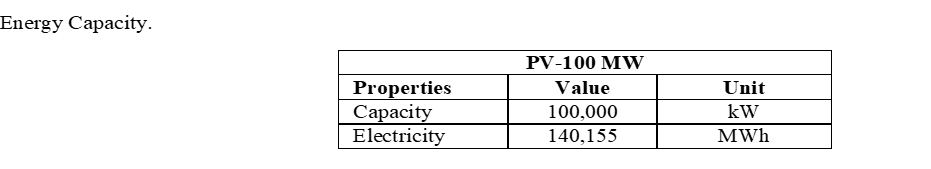

The energy assessment has been analyzed on the basis of the benchmark analysis in part 3.1 as well as the climatic information in segment 2.1. The intended capacity of the power plant is 100MW, implying that the power plant should consistently produce 100MW of electricity to the power grid. Unfortunately, the irradiation of solar energy varies on a daily basis as well as an hourly basis. So, achieving constant electricity generation is tough. Table 3 displays the energy capacity in terms of the projected solar power system. According to the capability of energy analyses, the determined capacity of the proposed power plant is 100MW, and the power provided to the local power grid is determined to be 140,155MWh.

Financial Viability

Economic feasibility is the capacity to produce enough revenue to pay operational expenses, and debts, when relevant, to permit growth and conserve service quality. As a result, the economic feasibility of the proposed power plant is reviewed in this section.

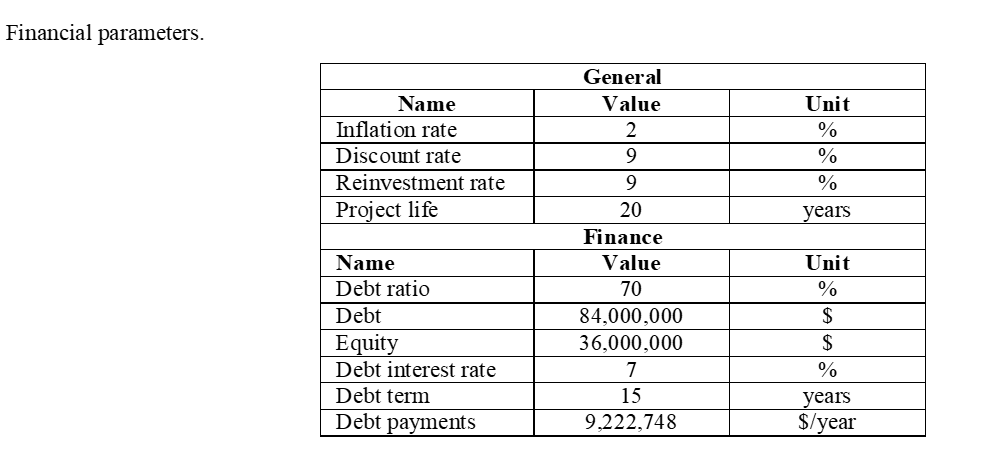

The financial parameters are the factors that determine whether or not a project is financially viable. The table below shows these financial parameters. The financial viability process depends on the contribution of the appropriate assumptions about the project life, the inflation rate, the reinvestment rate, and the discount rate.

The table below summarizes all costs and debt payments on a yearly basis. The project needs to pay $9,222,748 per year.

Get Help By Expert

Boost your performance in your Financial Management Assignment with our assignment helper Malaysia. We offer quality essay writing services and dedicated help with management assignments. Malaysian students can rely on our professionals for superior academic support. Connect with us now for the best results!

Recent Solved Questions

- MGT340: Human Resource Management Dissertation, UUM, Malaysia Human resources have played an important role in the success of the company. The quality of the human resource

- SBFS1103: Thinking Skills and Problem Solving Assignment, OUM, Malaysia A team of five persons is responsible for negotiating the prices of cables that suppliers provide to your company

- Marketing Assignment, OUM, Malaysia Design an advertisement for this product, which includes the description of the product and a new slogan

- Statistics Assignment, USM, Malaysia Let X be an exponential random variable, Show that for a > 0 and b > 0

- Describe how theories of speech and language development explain the emergence of communication: language development, Essay, Malaysia

- THEA1013 assignment: Theatrical Storytelling: Exploring the Unique Power of the Stage

- Marketing Assignment, UNM, Malaysia Classify firms according to the 4 different roles they might play leader, challenger, follower, and niche

- Accounting and Business Finance Dissertation, HWU, Malaysia It should be read in conjunction with the material available on CANVAS

- Accounting and Finance Assignment, UUM, Malaysia Great Excel Traders has a branch at Kota Tinggi. All accounts are maintained at the Head Office in Johor Bahru

- GSGM7324 Organisational Development and Change Management Assignment Malaysia