BAFB4124: UNITAR International University Assignment- Investment Analysis, Malaysia

| University | UNTAR International University (UIU) |

| Subject | BAFB4124: Investment Analysis |

Question 1

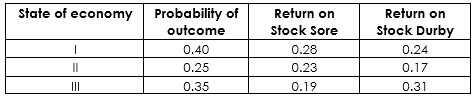

Small Investors Berhad, a large foreign mutual fund, is considering investing in stocks on Bursa Malaysia. One of the portfolio managers, Mr. Ramy, has identified two stocks, Sore and Durby, which have great potential and are considered blue-chip stocks. As a new investor in the local market, Mr. Ramy approached you to advise him on which one of the two stocks should be selected. He provides you with the following information for analysis.

- Calculate the expected return and standard deviation for both stocks. Advise Mr. Ramy on the investment he should choose.

- Calculate the covariance between the two stocks.

- Calculate the expected return and standard deviation of a portfolio consisting of 60% Sore and 40% Durby.

Question 2

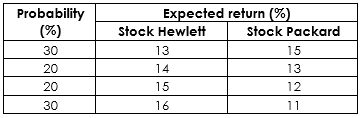

Amanda Tan cannot decide whether to invest in Stock Hewlett or Stock Packard or in a portfolio that is a combination of both stocks. She has approached OSK Securities and the firm has provided her with the following information:

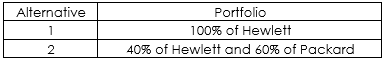

Using these stocks, she has identified two investment portfolio alternatives :

a) Calculate the portfolio return and standard deviation for each alternative.

b) Based on the findings above, which of the two alternatives would she choose? Explain your answer.

Question 3

John currently has a portfolio of shares giving a return of 20% with a risk of 10%. He is considering a new investment which gives a return of 20% with a risk of 12%. The coefficient of correlation of the new investment with his existing portfolio is +0.2. The new investment will comprise 40% of his enlarged portfolio. Should he invest in the new investment?

Question 4

Redesign Corp is considering a new strategy that would increase its expected return from 12% to 13.9%, but would also increase its beta from 1.2 to 1.8. If the risk-free rate is 5% and the return on the market is expected to be 10%, should Redesign change its strategy?

Question 5

Qin Bhd has a systematic risk of 6%. The market is giving a return of 12% with a risk of 4%. The risk-free rate is 5%. What will be the required return from Qin Bhd?

Question 6

Tuck Bhd is giving a return of 20%. The stock exchange as a whole is giving a return of 25% with a risk of 8%, and the return on government securities is 8%. What is the β of Tuck Bhd, and what is the systematic risk of Tuck Bhd?

Get Help By Expert

Looking for help with your BAFB4124: Investment Analysis assignment? Our assignment helper Malaysia service connects you with experts in finance and investment. If you're struggling with complex calculations or portfolio management, you can hire someone to do my assignment to ensure accurate and well-structured solutions. Our experts offer tailored programming assignment help and financial analysis to help you succeed in your course.

Recent Solved Questions

- FIN10004: Customers in the Corporate segment are often more likely to place larger orders than their consumer counterpart: Financial Statistic, Report, UTM, Malaysia

- Bachelor of Communication with Honours Assignment, OUM, Malaysia Identify and list the research objectives and Who is the target audience of the research

- BNNS 6443 Mental Health Nursing Individual Assignment Essay | LUC Malaysia

- Environmental Science Assignment, UON, Malaysia Each group are required to elaborate on how the greening and sustainability of the Malaysian waste sector can be strategically enhanced

- Data Organization and Information Management in Daily Life, Individual Assignment, Malaysia

- Educational Assessment: Test Design and Evaluation

- International Business Issues and Polices Assignment, APU, Malaysia Poverty is considered one of the major hindrances to the economic development in the least developed countries

- GEO ENGINEERING Essay, UITM, Malaysia Evaluate the role of Ocean fertilization in addressing climate change In the introduction briefly explain climate change and ocean fertilization

- BADB1014: Quantitative Methods Assignment, UIU, Malaysia

- HR Management Report, OUM, Malaysia Sedap Fried Chicken Bhd is a new and rapid growing fast-food company in Malaysia