FIN30014: Financial Risk Management Case Study, SUT, Malaysia Industrial commodities in China mostly rose as the number of Covid-19 cases fell and the government began to loosen the restrictions

| University | Swinburne University of Technology (SUT) |

| Subject | FIN30014: Financial Risk Management |

Question

Industrial commodities in China mostly rose as the number of Covid-19 cases fell and the government began to loosen the restrictions that were choking the economy.

The virus is now deemed under control in Beijing, while Shanghai’s outbreak appears to be heading that way as officials outlined their plan to revive the city after a two-month lockdown. Measures include allowing manufacturing to restart, accelerating property approvals, and making car purchases cheaper, all metals-intensive areas that had been hit hard by the virus.

Still, there’s a lot of ground to be made up. The factory PMI due on Tuesday will probably remain in contraction, according to Bloomberg Economics, although it should recoup some of the steep losses recorded in April after slight improvements in oil refining and steel output. More broadly, China’s growth outlook has been slashed, amid a Covid Zero policy that could yet condemn the

country to further punish lockdowns even as the government ramps up stimulus to get the economy back on track.

Among individual commodities, steel demand is likely to remain depressed as policymakers continue to discourage housing speculation, according to Capital Economics. The London-based research firm forecasts that hot-rolled coil will fall 10% to 4,200 yuan a ton by the end of the year. For copper, the onshore view is that demand prospects are weak, although news of extra spending on the power grid, the biggest user of the metal in China, should prove supportive.

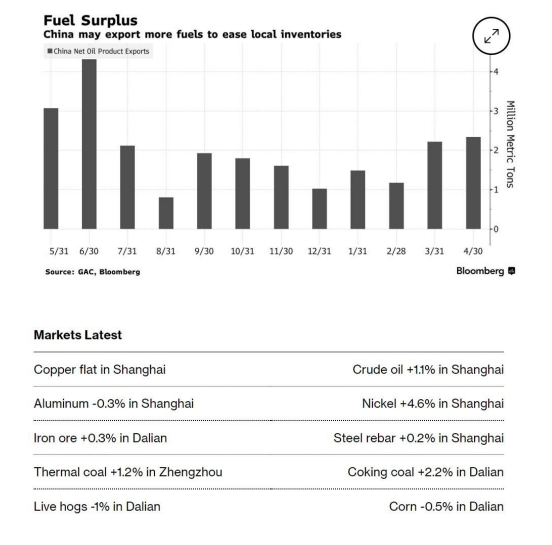

Today’s Chart

China may take steps to clear high fuel inventories that have built up during prolonged anti-virus lockdowns by issuing additional export quotas, a measure that would raise competition among refiners across the region.

On The Wire

At a time when food shortages and soaring prices are becoming a major concern for governments around the world, China is going all out to make sure that its summer wheat harvest proceeds without any hitches.

Required:

(a) Assume you are the lead hedge strategist at BHP Group Ltd., an Australian multinational mining, metals, and petroleum company. BHP is expected to produce 23 million metric tons of Iron Ore in the next 3 months. Based on the above article, would you recommend BHP to hedge its exposure to Iron Ore? Critically analyze your recommendation to hedge or not.

(b) Irrespective of your answer to (a), assume you are required to hedge iron ore price risk. Between futures and options (single and multiple option strategies) which strategy/instrument would you recommend and why? Provide the reason for your choice above all other strategies.

Recent Solved Questions

- TEE103: (a) Solve the voltage v0 in Figure 8 by using mesh analysis: Circuit Theory I Assignment, WOU, Malaysia

- BMBR5103: Business Research Methods Assignment, OUM, Malaysia Leadership styles and performance of academic staff in the education industry in Malaysia

- BCS1107: ADVANCED WEB TECHNOLOGY Report, UiTM, Malaysia The objective of the assignment is to develop a web application using web 2.0 technologies

- Business Law Assignment, APU, Malaysia Shaun is a fitness model and an influencer. The content covers the importance of fitness and healthy diets

- ATF20603 BUSINESS ACCOUNTING Financial Records and Performance Analysis

- Foreign Policy Analysis Assignment, AeU, Malaysia TN any area of scholarly inquiry, there are always several ways in 1 which the phenomena under study may be sorted and arranged

- Programming Principle and Techniques Assignment, UIU, Malaysia You are working as a software engineer in a retail company named Auni Store Sdn Bhd. Your manager asked you to solve a programming

- Construction Management Research Paper, WOU, Malaysia Sustainability in construction emphasizes utilizing natural resources responsibly and efficiently throughout

- Essentials of Fintech Assignment, APU, Malaysia The Securities Commission Malaysia (SC) is keen to work with intermediaries and financial technology providers to employ

- Process Safety Management Assignment, UTP, Malaysia A fire struck out at Kemaman Bitumen Company Sdn Bhd located at Teluk Kalong Industrial Area