FIN30014: Financial Risk Management Case Study, SUT, Malaysia Industrial commodities in China mostly rose as the number of Covid-19 cases fell and the government began to loosen the restrictions

| University | Swinburne University of Technology (SUT) |

| Subject | FIN30014: Financial Risk Management |

Question

Industrial commodities in China mostly rose as the number of Covid-19 cases fell and the government began to loosen the restrictions that were choking the economy.

The virus is now deemed under control in Beijing, while Shanghai’s outbreak appears to be heading that way as officials outlined their plan to revive the city after a two-month lockdown. Measures include allowing manufacturing to restart, accelerating property approvals, and making car purchases cheaper, all metals-intensive areas that had been hit hard by the virus.

Still, there’s a lot of ground to be made up. The factory PMI due on Tuesday will probably remain in contraction, according to Bloomberg Economics, although it should recoup some of the steep losses recorded in April after slight improvements in oil refining and steel output. More broadly, China’s growth outlook has been slashed, amid a Covid Zero policy that could yet condemn the

country to further punish lockdowns even as the government ramps up stimulus to get the economy back on track.

Among individual commodities, steel demand is likely to remain depressed as policymakers continue to discourage housing speculation, according to Capital Economics. The London-based research firm forecasts that hot-rolled coil will fall 10% to 4,200 yuan a ton by the end of the year. For copper, the onshore view is that demand prospects are weak, although news of extra spending on the power grid, the biggest user of the metal in China, should prove supportive.

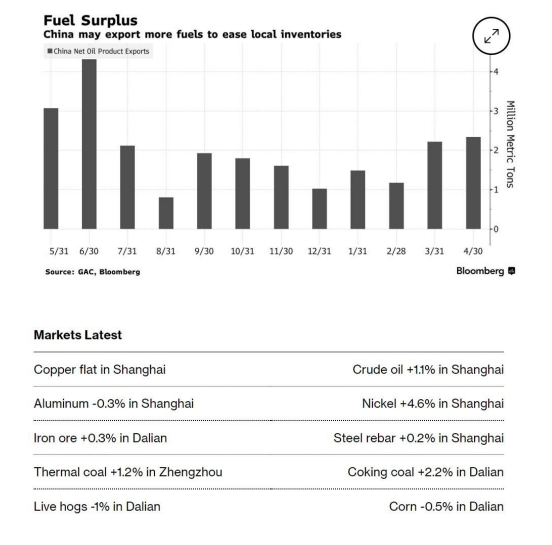

Today’s Chart

China may take steps to clear high fuel inventories that have built up during prolonged anti-virus lockdowns by issuing additional export quotas, a measure that would raise competition among refiners across the region.

On The Wire

At a time when food shortages and soaring prices are becoming a major concern for governments around the world, China is going all out to make sure that its summer wheat harvest proceeds without any hitches.

Required:

(a) Assume you are the lead hedge strategist at BHP Group Ltd., an Australian multinational mining, metals, and petroleum company. BHP is expected to produce 23 million metric tons of Iron Ore in the next 3 months. Based on the above article, would you recommend BHP to hedge its exposure to Iron Ore? Critically analyze your recommendation to hedge or not.

(b) Irrespective of your answer to (a), assume you are required to hedge iron ore price risk. Between futures and options (single and multiple option strategies) which strategy/instrument would you recommend and why? Provide the reason for your choice above all other strategies.

Recent Solved Questions

- Preventing Accident at Workplace Understanding with OSHA

- BBPS4103: The objective of this assignment is to enhance individual learners’ skills, knowledge, and understanding in generating effective and efficient strategies: Strategic Management Pengurusan Strategik, Assignment, OUM, Malaysia

- EDF5544: Group counselling skills and psychotherapy Essay, MUM, Malaysia: Students are required to watch the above movie and complete a review of the movie based on the group therapy

- BBM207: HRM in the ‘New Millennium’, discuss on the changing roles of HR in accordance to that: Human Resource Management, Assignment, WOU, Malaysia

- BNRS 6214: Introduction to Research Methodology $ Statistic for Nurses Assignment, LUC, Malaysia The student is required to write a quantitative research proposal about any topic of interest

- MBM3783: Social Marketing Case Study, UoTS, Malaysia A local woman claims to have been cheated of over RM1.4 mil after meeting someone online who claimed to be a South African engineer

- Finance, Accounting and Management Assignment, UON, Malaysia Company SBS9 is evaluating the following list of Investments The target capital structure is to use 50% Debt and 50% Equity

- BDNG3103: Introductory International Business Assignment, OUM, Malaysia Assume that Proton plans to expand its market by setting up a new production facility in Saudi Arabia in the year 2023

- Science Research Paper, UM, Malaysia Corrosion is generally understood to be the destruction of a metal by the action of corrosive agents

- Diploma in Land Survey Assignment, UTM, Malaysia Calculate the volumes of cut and fill contained between consecutive cross-sections from CS10 and CS15