DBAF2003: Principles of Accounting Assignment, UoC, Malaysia On 1 January 2011, Yen had two vehicles for use in his business. Vehicle X was bought several years earlier for £7.500

| University | University of Cyberjaya (UoC) |

| Subject | DBAF2003: Principles of Accounting |

Question 1

On 1 January 2011, Yen had two vehicles for use in his business. Vehicle X was bought several years earlier for £7.500 and vehicle Y was purchased in 2010 for £10.500.

On 31 December 2011, he sold vehicle X for £3.600 and replaced it with, vehicle Z. paid for by cheque.

Yen’s policy is to provide depreciation on vehicles at 25% per annum, on the reducing balance method. A full year’s depreciation is charged in the year of purchase and none in the year of disposal.

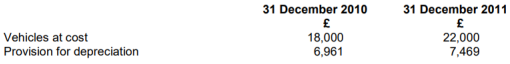

The balances in Yen’s accounts were as follows:

Question 2

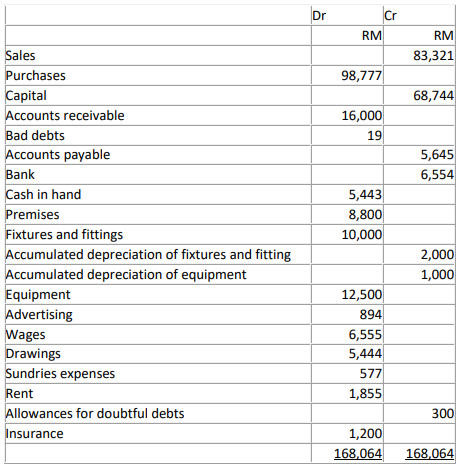

From the following trial balance of C Roddy, after her first year’s trading, you are asked to draw up a trading and profit and loss account for the year ended 30 June 20X4.

Question 3

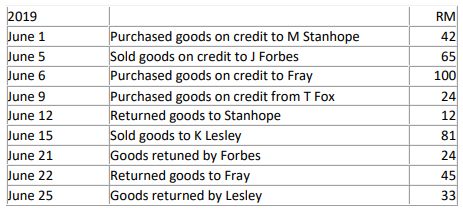

Mary, a sole trader, has the following transactions for the month of June 20X6.

Question 4

Robby Ltd has the following items in its statement of financial position on 30th November 2019; Van for

RM23,000, fixtures RM12,000, inventory RM12,000, cash in hand RM7,500, cash at bank RM10,000,

accounts receivable RM5,500, accounts payable RM10,000, capital RM 45,000, and loan RM15,000.

During the first week of December 2019

- Bought fixtures for RM2000 on credit

- Bought inventory RM1040 for cash

- Debtors paid RM1500 by cheque.

- Paid creditors RM300 by cheque and 300 cash.

- Introduce RM2160 into the business, RM 1400 cash, and RM760 by cheque.

- Take a loan of RM2000 from Roy in cash.

Get Help By Expert

Unlock the secrets of DBAF2003: Principles of Accounting with the assistance of Assignment Helper MY. Our team of dedicated professionals specializes in guiding students through the intricacies of accounting principles. From understanding accruals and deferrals to analyzing financial statements, we are committed to helping you excel in your accounting coursework.

Recent Solved Questions

- OUMH1603: How can we balance the urgent need for global action on climate change with the unique challenges: Learning Skills For 21st Century, Assignment, OUM, Malaysia

- SIQ3004: Mathematics of Financial Derivatives Assignment, UM, Malaysia Discuss the moneyness of your call and put warrants based on the latest date of your data. If your call and put warrants

- CBWP2203 Tugasan : Sep 2024 – Pengaturcaraan Web, OUM, Malaysia

- AI Deepfake Cybersecurity Assignment: Evaluating Security Risks and Detection Techniques for Safe Digital Environments

- AINT003-4-C: You are required to develop a website with an appropriate web development tool: Web Design And Technology, Individual Assignment, APU, Malaysia

- Entrepreneurship Assignment, UKM, Malaysia Entrepreneurship is the art of creating something new, whether a new business or enterprise

- ACC7102E: ACCOUNTING AND FINANCE FOR MANAGERS Assignment, UOM, Malaysia You are expected to be resourceful, innovative and creative when communicating and presenting your discussion

- Business Statistics Assignment, SU, Malaysia In statistics, there are dependent and independent variables. Dependent variables are so-called because

- The management team of a company decided to undertake organisational change management strategies: Organizational development and change management Case Study, UIU, Malaysia

- Business Law Course Work, TU, Malaysia Lim agreed to sell to Ricky his house “Awesome Villa” on Tioman Island at the prevailing market value. Before the contract was signed