Taxation Assignment, UTAR, Malaysia Kenchana Sdn Bhd is a trading company. It commenced its business on 1 October 2019 and closes its account

| University | Universiti Tunku Abdul Rahman (UTAR) |

| Subject | Taxation |

- Kenchana Sdn Bhd is a trading company. It commenced its business on 1 October 2019 and closes its account on 31 May each year. The following are assets owned by the company

Furniture

The furniture was for personal use before it was brought for the company’s use on 1 March 2021. The market value and net book value of the furniture on that date were RM15,000 and RM11,500 respectively.

Second-hand Car

On 1 April 2020, a second-hand car (not for commercial use) was bought on hire purchase. The cash price of the car was RM130,000 and a deposit of RM30,000 was paid on 1 April 2020. The installment payment is RM2,700 per month for 40 months commencing from 1 April 2020. On 1 February 2022, the motor vehicle was sold for RM75,000.

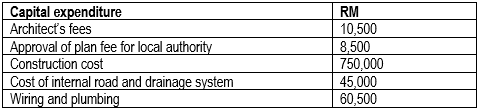

- Sri Setia Sdn Bhd is a manufacturing company, that commenced its business on 1 August 2018 and made up its accounts to 31 December annually. The company bought a piece of land in November 2018 for RM3,000,000 for the purpose of constructing a new factory. A legal fee of RM32,000 was incurred on the Sale and Purchase Agreement of the land. A few months later, an old factory situated on the land was demolished at the cost of RM250,000. The construction commenced in March 2019 with the following costs:

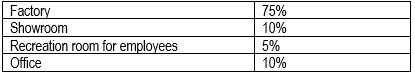

The construction was completed and put into use in June 2020. The management of the company agreed that the built-up area of the building was allocated for the following purposes:

Due to the expansion of the business, Sri Setia Sdn Bhd constructed another building that is used as a warehouse for the storage of goods for export. The qualifying expenditure for the building was RM250,000. The building was completed on 1 July 2022 and was brought to use on 15 August 2022.

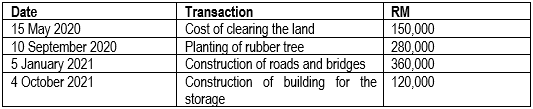

- Alpha Plantation Sdn Bhd (accounting year ends 31 October) was incorporated in April 2020 and owns a piece of land in Kuantan, Pahang to carry on the rubber tree plantation business. The company incurred the following expenditure related to the planting of rubber trees.

On 31 August 2022, the whole farm was sold to Omega Plantation for RM950,000 due to financial difficulties.

Get Help By Expert

Assignmenthelper.my is the essay writing help website you've been looking for! Whether you need assistance in essay writing, or proofreading, or want to elevate your essay to an entirely new level - Assignmenthelper.my is your best bet., we offer comprehensive assignment help, extending to Accounting and Finance Management assignments. Our team of dedicated professionals is here to provide you with guidance at each step and make sure that your essay writing journey is as smooth sailing as possible. Hire our assignment help experts and witness an instant uplift in the quality of your essay submissions overnight!

Recent Solved Questions

- You are working as a Human Resources Manager in a medium-sized company: Quantitative Methods for Business Research, Assignment, MSU, Malaysia

- Manufacturing Technology Assignment, UTHM, Malaysia The manufacturing of various products is done at different scales ranging from humble domestic production of say

- The Effect Of Traditional Classroom Management On Student Performance In An Ib Myp Classroom: Education, Research Paper, Malaysia

- BBPS4103: Strategic Management Assignment, OUM, Malaysia Conduct an internal analysis for Apollo Food Holdings Berhad and an external analysis for the industry related to the company.

- BUSM50003: Big Data Research Paper, SU, Malaysia Explain your research philosophy and methodologies and In particular, comment on the research design

- MGT555: Business Analytics Assignment, UiTM, Malaysia Refer to the Cell Phone survey dataset in Excel, it consists of items such as gender, type of cell phone, usage, carrier

- BBPB2103: HUMAN RESOURCE MANAGEMENT Assignment, OUM, Malaysia The purpose of this assignment is to enhance learners’ ability to explain the disciplinary procedures and challenges in taking disciplinary

- Bachelor of Performing Arts Assignment, TU, Malaysia Discuss three symbolisms in the play Macbeth and how they support the central theme of the play

- OUMH2203: You are an English language trainer working for a multinational company in Kuala Lumpur, Malaysia: English For Workplace Communication Assignment, OUM, Malaysia

- Crime and Society Assignment, UUM, Malaysia Social control is the study of the mechanisms, in the form of patterns of pressure, through which society maintains