BBF30403 Assignment: Corporate Finance, Investment Analysis, and Key Financial Concepts Explained

| University | City University Malaysia (CUM) |

| Subject | BBF30403 Corporate Finance Assignment |

SECTION A : (25 MARKS)

1. Explain the importance of a stock market to a financial manager.

2. Fixed income securities

3. Primary security markets

4. Closed End Funds

5. Discuss the three main roles played by financial institutions in the corporate finance.

SECTION B :

ANSWER 3 OUT OF 5 QUESTIONS.

QUESTION 1

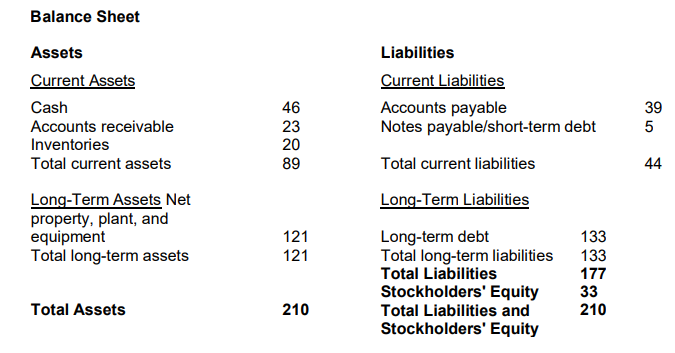

The below diagram shows a balance sheet for a certain company. All quantities shown are in millions of dollars. What is the company’s net working capital?

QUESTION 2

You are planning for retirement 34 years from now. You plan to invest RM4,200 per year for the first 7 years, RM6,900 per year for the next 11 years, and RM14,500 per year for the following 16 years (assume all cash flows occur at the end of each year). If you believe you will earn an effective annual rate of return of 9.7%, calculate your retirement investment will be worth in 34 years from now.

QUESTION 3

If Rashdan currently deposited RM2500 in his personal account, with 4% interest rate calculate his account balance at the end of 10 year using calculation compounded annually and compounded quarterly

QUESTION 4

Explain the issues of ethical practices among investors when considering various types of investments and support your answer with examples.

QUESTION 5

Describe in detail the FIVE (5) classifications of common stocks.

SECTION C :

ANSWER 3 OUT OF 5 QUESTIONS.

QUESTION 1

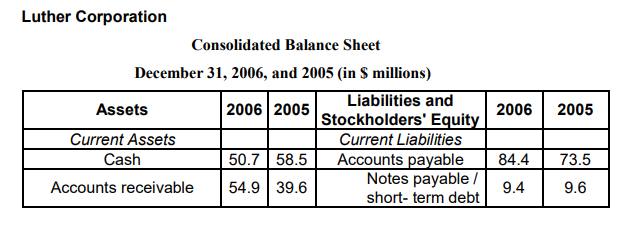

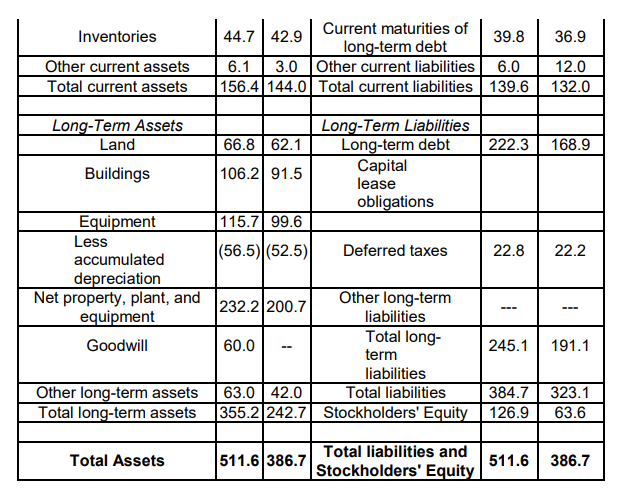

Refer to the balance sheet below, what is Luther’s net working capital in 2006?

QUESTION 2

You are considering buying a printing machine that will require an initial outlay of $54,200. The printing machine has an expected life of 5 years and will generate free cash flows to the company of $20,608 at the end of each year over its 5-year life. In addition to the $20,608 cash flow from operations during the fifth and final year, there will be an additional free cash inflow of $13,200 at the end of the fifth year associated with the salvage value of the printing machine, making the cash flow in year 5 equal to $33,808. Thus, the cash flows associated with this project are as follow:

| Cash Flow | |

| Initial Outlay | -$54,200 |

| Inflow year 1 | $20,608 |

| Inflow year 2 | $20,608 |

| Inflow year 3 | $20,608 |

| Inflow year 4 | $20,608 |

| Inflow year 5 | $33,808 |

Given a required rate of return of 15 percent, calculate the following

i. Payback period (4 marks)

ii. NPV (5 marks)

iii. PI (4 marks)

iv. Should this project be accepted? Justify your answer. (2 marks)

QUESTION 3

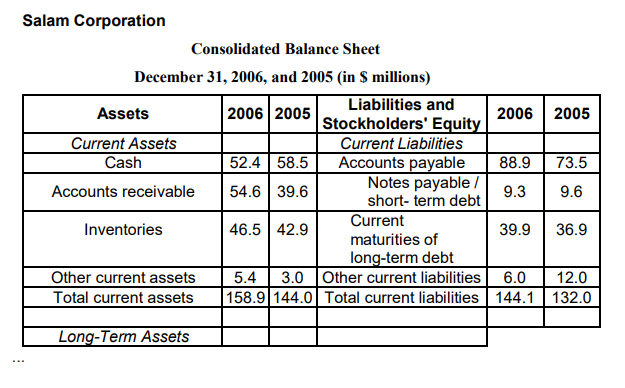

Refer to the balance sheet below, identify and explain the change in Salam’s quick ratio from 2005 to 2006.

Get Help By Expert

Need help with your BBF30403 Assignment Questions? Don't Worry! The best online assignment help services for Malaysian students are available here. Just write "do my assignment" and get your assignment before the deadline. Contact us now!

Recent Solved Questions

- Strategic Management Assignment, ASB, Malaysia You are required to introduce your selected automobile company and highlight the key issues that the company is currently facing

- Advanced Data Analysis Assignment, TARC, Malaysia: Imagine you are Stephen Spielberg. You are in the planning stages of a movie in 2054

- What effect do sustainable business practices have on consumer buying behaviour: Research Methodology Individual Assignment, APU, Malaysia

- MMK48103 Material for Energy and Environmental Sustainability Sustainable Energy Systems and Waste Recycling

- Management and Science Assignment, MSU, Malaysia Your group is the investment review committee of RT Property Management Sdn Bhd

- Research Skills for International Business Assignment, TU, Malaysia Critically discuss how you might sample and collect qualitative data to assist you in achieving your research question

- Finance Assignment, UM, Malaysia Ratio analysis can be used for identifying some of the issues of a firm. Indeed, Ratios draw the management’s attention

- Java Programming Assignment, UniKL, Malaysia The application shall display all the GUI components as illustrated in the figure. Users need to enter details

- Arnold Palmer Hospital is studying the number of emergency surgery kits that is uses on weekends: Optimization Technique Assignment, UMP, Malaysia

- Organizational Behavior Assignment, TU, Malaysia Authentic leaders lead from strong, personal, moral values that can have a profound effect on your organization