TAX317: TAXATION 2 Assignment, UiTM, Malaysia Business entity located in Malaysia that manufactures taxable goods not exempted under the Sales Tax Act 2018

| University | Universiti Teknologi MARA (UiTM) |

| Subject | TAX317: TAXATION 2 |

- You are required to create a business entity located in Malaysia that manufactures taxable goods not exempted under the Sales Tax Act 2018, Sales Tax Order 2018, and any other recent applicable exemption orders of the Minister of Finance. Your business entity should have the followings profile:

i. Name of your business entity and the type of business organization.

ii. Date of business registration and commencement.

iii. Registered address and contact details (telephone, email) of your business.

iv. Place of manufacturing address.

v. Name of owners/directors.

vi. List at least TWO (2) taxable goods manufactured by your business.

- Assumes that the following information are pertaining to your business:

a. The business carries out manufacturing activities to produce taxable goods.

b. Financial year ends on 30 June each year.

c. Sales transactions are performed on both cash and credit basis.

d. Goods manufactured and sold are under the category of taxable goods.

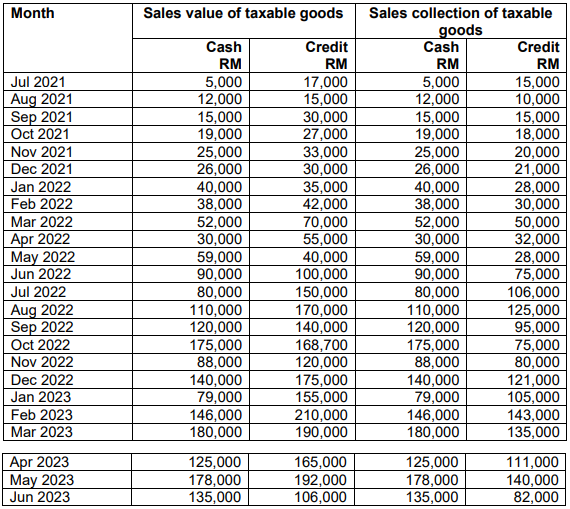

e. Below are the Monthly Sales Report for the financial year end 2022 and the Projected Sales Report for the financial year end 2023.

i. Based on the above information, explain when your business is required to apply for the sales tax registration using the historical method (support your answer with relevant computation and by filing the SST-01 form).

ii. Explain when will your business charge sales tax to customers.

iii. For each of the following items made by your business, calculate the amount due to RMCD (if any) according to the Sales Tax Act 2018. Justify your answer if the transaction is not subjected to sales tax.

a. For cash sales made in the month of January 2022.

b. For credit sales made in the month of May 2022.

c. For RM75,000 sales made in June 2022 which were sold to customers in designated areas.

d. For RM25,000 of sales made in June 2022 has been donated to charity organizations in Malaysia. The cost of the goods donated amounted to RM18,000.

iv. Based on information in (iii), explain the submission requirement of SST-02 and payment of sales tax.

v. Based on information in (iii) and (iv), describe the consequences according to

Sales Tax Act 2018 if your business remitted the amount of sales tax to RMCD on 15 September 2022

vi. Assuming today is 31 March 2023. The following is information about one of your customers.

Get Help By Expert

Assignmenthelper.my is your one-stop shop for thesis writing services! We pride ourselves in providing stress-free and affordable thesis writing assistance for students of all backgrounds and academic levels. With the help of our professional assignment writers, you can count on a personalized thesis paper that meets all of your research requirements and is supported by reliable evidence in a timely manner. Additionally, we extend our expertise to CHE433 Thermodynamics Assignment and other subjects. Trust AssignmentHelper.my for comprehensive thesis writing services and reliable solutions to all your academic challenges.

Recent Solved Questions

- MPU3223_v2: Tugasan ini direka untuk mengembangkan kemampuan pelajar untuk memahami kepentingan kreativiti: Keusahawanan II May 2024 Semester, Assignment, OUM, Malaysia

- Certified Financial Planner Assignment, UTAR, Malaysia Some weeks ago, you (Danny Lim) a Certified Financial Planner (CFP) and a licensed Financial Planner met your old friend

- PKK5901: Evaluation of Dissertation Proposal, first phase by supervisor and examiners: DISSERTATION Assignment, UPM, Malaysia

- Disease Prevention Assignment, UKM, Malaysia Globally, healthcare systems are being affected by the rapid, dynamic changes in advancements in biomedical science

- Principle of Marketing Report, UNM, Malaysia Today’s marketers are also using sophisticated analytical techniques to track consumers’ digital movements and to build

- Network Analysis Assignment, CUSCT, Malaysia Figure 1 shows an electric circuit network. Using the proper tree in Figure 2, determine all the voltage and current for each edge

- Film, Television and Screen Studies Assignment, UON, Malaysia Identify the main aspects of mise-en-scene that are being used. Which are most important and why

- CHEN5017: Process Plant Engineering Assignment, CU, Malaysia Hydrogen is touted to be one of the most promising energy carriers which can supply the world’s energy demand .

- Computer Science Assignment, UTM, Malaysia Supermarkets are enormous businesses that utilize a lot of data. Supermarkets have steadily taken up a larger

- Choose a local company that you know well and can access information about. The company should either: Strategic Business and Management Assignment, Malaysia