BBM206: Accounting and Costing Assignment, WOU, Malaysia

| University | Wawasan Open University (WOU) |

| Subject | BBM206: Accounting and Costing |

Question 1

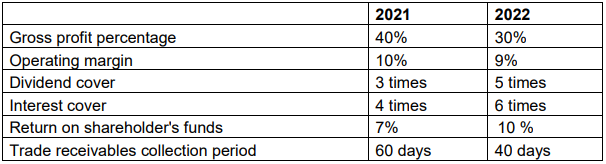

San Bhd manufactures and distributes glassware in Malaysia. The following

ratios are based on its financial statements for the years ended 31 December

2021 /2022.

- State the formula for each of the above ratios.

- Comment on each of the above ratios.

Question 2

Sim depreciates his machinery at a rate of 20% per annum on a reducing balance basis. He provides a full year’s depreciation in the year an asset is acquired, and no provision is made in the year of disposal.

On 1 November 2021, the cost of Sim’s machinery was RM140,900, and the net book value was RM94,570.

During the year to 31 October 2022, a machine that had cost RM35,000 and had been depreciated for four years was traded in for a new machine. The new machine cost RM50,000, and the trade-in value was RM14,000. On 31 October 2022, the balance of the cost of the new machine was still outstanding.

a. Calculate the profit or loss on the machine traded in.

b. Calculate the depreciation charge for machinery for the year 31 October 2022.

c. Show the following ledger accounts for the year:

i. Machinery at cost.

ii. Accumulated depreciation.

Get Help By Expert

Need help with your BBM206 Accounting and Costing Assignment? Our assignment helper Malaysia service is here for you! If you're thinking, "I need someone to do my assignment for me," or need expert help with accounting assignments, we've got you covered. With experienced professionals, 100% original content, and on-time delivery, we make sure you succeed in your coursework stress-free.

Recent Solved Questions

- Accounting Essay, UON, Malaysia Tulip Berhad sold goods to Mawar Berhad for RM1.5 million. The margin was 20% on the selling price which was the normal markup

- BUSN11079: Analytical Thinking And Decision Making Report, UWS, Malaysia Discuss The Value Of Decision Analysis Within The Context Of An Organization

- FAR210: As at 31 December 2022, a physical stock count was carried out to determine the value: Financial Accounting III Assignment, UiTM, Malaysia

- FAR570: Financial Accounting and Reporting 4 Assignment, UiTM, Malaysia The Malaysian Private Entities Reporting Standards issued by Malaysian Accounting Standards Board are applicable

- International Business Assignment, APU, Malaysia Which aspects of globalization has a positive or negative affect on YOUR COMPANY OR YOUR INDUSTRY

- ELC501: English for Critical Academic Reading Assignment, UiTM, Malaysia Malaysian car buyers have come a long way in the past ten years or so. From only caring about looks, performance

- Medical Research Case Study, MU, Malaysia A new genome-editing technology namely Clustered Regularly Interspaced Palindromic Repeats has been discovered

- Mobile Phone Development Assignment, UTM, Malaysia The proposed development of a mobile phone app by the Computer Science department would serve many perceived needs

- LAW416: Business Law Assignment, UiTM, Malaysia Azmir Shane the original owner of a white BMW entrusted his car to a mechanic named, Andy Danial for repairs

- D30IC: Innovation In Construction Practice Case Study, HWU, Malaysia Originally proposed in 2010 by the Malay real estate developer PNB. With the initial foundation and groundworks commencing