BBF30403 Assignment: Corporate Finance, Investment Analysis, and Key Financial Concepts Explained

| University | City University Malaysia (CUM) |

| Subject | BBF30403 Corporate Finance Assignment |

SECTION A : (25 MARKS)

1. Explain the importance of a stock market to a financial manager.

2. Fixed income securities

3. Primary security markets

4. Closed End Funds

5. Discuss the three main roles played by financial institutions in the corporate finance.

SECTION B :

ANSWER 3 OUT OF 5 QUESTIONS.

QUESTION 1

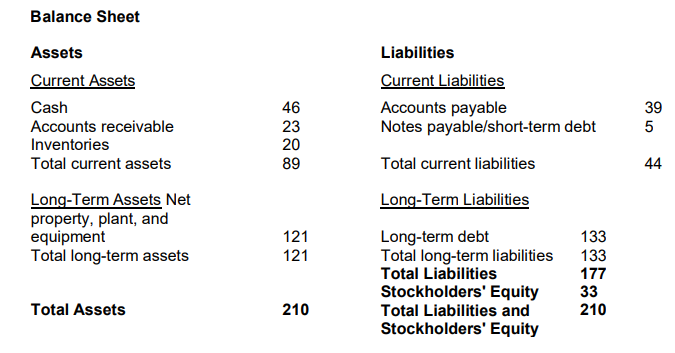

The below diagram shows a balance sheet for a certain company. All quantities shown are in millions of dollars. What is the company’s net working capital?

QUESTION 2

You are planning for retirement 34 years from now. You plan to invest RM4,200 per year for the first 7 years, RM6,900 per year for the next 11 years, and RM14,500 per year for the following 16 years (assume all cash flows occur at the end of each year). If you believe you will earn an effective annual rate of return of 9.7%, calculate your retirement investment will be worth in 34 years from now.

QUESTION 3

If Rashdan currently deposited RM2500 in his personal account, with 4% interest rate calculate his account balance at the end of 10 year using calculation compounded annually and compounded quarterly

QUESTION 4

Explain the issues of ethical practices among investors when considering various types of investments and support your answer with examples.

QUESTION 5

Describe in detail the FIVE (5) classifications of common stocks.

SECTION C :

ANSWER 3 OUT OF 5 QUESTIONS.

QUESTION 1

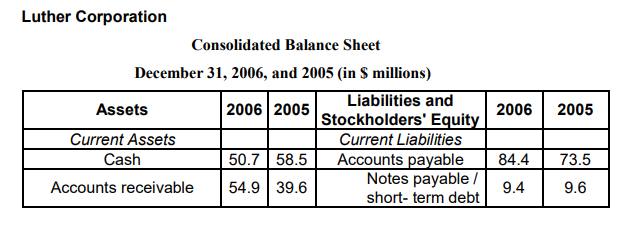

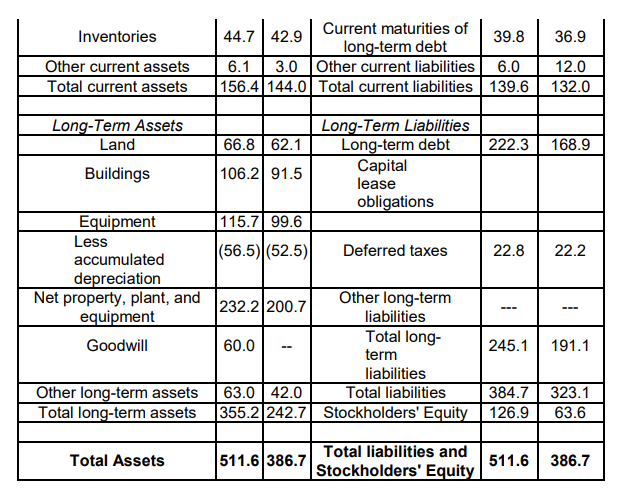

Refer to the balance sheet below, what is Luther’s net working capital in 2006?

QUESTION 2

You are considering buying a printing machine that will require an initial outlay of $54,200. The printing machine has an expected life of 5 years and will generate free cash flows to the company of $20,608 at the end of each year over its 5-year life. In addition to the $20,608 cash flow from operations during the fifth and final year, there will be an additional free cash inflow of $13,200 at the end of the fifth year associated with the salvage value of the printing machine, making the cash flow in year 5 equal to $33,808. Thus, the cash flows associated with this project are as follow:

| Cash Flow | |

| Initial Outlay | -$54,200 |

| Inflow year 1 | $20,608 |

| Inflow year 2 | $20,608 |

| Inflow year 3 | $20,608 |

| Inflow year 4 | $20,608 |

| Inflow year 5 | $33,808 |

Given a required rate of return of 15 percent, calculate the following

i. Payback period (4 marks)

ii. NPV (5 marks)

iii. PI (4 marks)

iv. Should this project be accepted? Justify your answer. (2 marks)

QUESTION 3

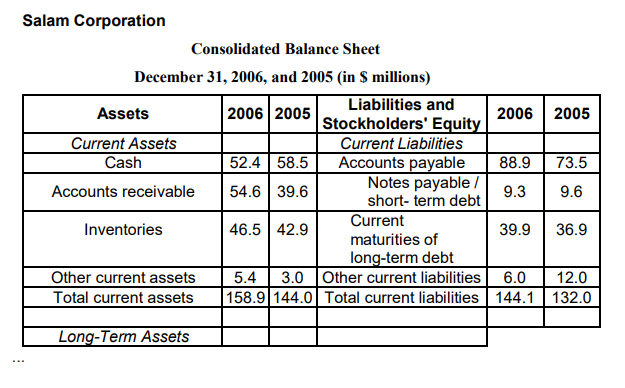

Refer to the balance sheet below, identify and explain the change in Salam’s quick ratio from 2005 to 2006.

Get Help By Expert

Need help with your BBF30403 Assignment Questions? Don't Worry! The best online assignment help services for Malaysian students are available here. Just write "do my assignment" and get your assignment before the deadline. Contact us now!

Recent Solved Questions

- ASSIGNMENT 1: Analysis and Proposal for Process Improvement In An Organisation – City University Malaysia

- FHHM1114 INTRODUCTION TO SOCIOLOGY OCTOBER 2024 TRIMESTER Assignment

- BDEK2203: Introductory Macroeconomics Assignment, OUM, Malaysia Illustrate and explain the Gross Domestic Product (GDP) and unemployment for Malaysia for the years 2018-2021 using graphs

- Data Science Coursework, APU, Malaysia Explain your dataset in detail: source, number and types of attributes

- MPHR7113 Assignment 1: Marketing Management IKEA Malaysia Retention Strategy – City University Malaysia

- BAC3644: Taxation 2 Assignment, MMU, Malaysia Platina Jubilee Sdn. Bhd. was incorporated in Malaysia on 5th May 2017 with an authorized ordinary share capital

- European Union Course Work, UM, Malaysia Italy has just passed an important piece of legislation designed to promote trade opportunities for Italian companies

- Management and Leadership in Education Assignment, UPM, Malaysia Ms. Sara is a principal at a secondary school in Malaysia who has noticed that her teachers seem stressed and overwhelmed

- BARB4034: Product and Branding Strategy Assignment, UIU, Malaysia Advertising agency, Young and Rubicam (Y&R) developed a tool to diagnose the power and value of a brand

- BMMB1134 Pentaksiran Berterusan Keterampilan Assignment 2026 | IPGM