DBAF2003: Principles of Accounting Assignment, UoC, Malaysia On 1 January 2011, Yen had two vehicles for use in his business. Vehicle X was bought several years earlier for £7.500

| University | University of Cyberjaya (UoC) |

| Subject | DBAF2003: Principles of Accounting |

Question 1

On 1 January 2011, Yen had two vehicles for use in his business. Vehicle X was bought several years earlier for £7.500 and vehicle Y was purchased in 2010 for £10.500.

On 31 December 2011, he sold vehicle X for £3.600 and replaced it with, vehicle Z. paid for by cheque.

Yen’s policy is to provide depreciation on vehicles at 25% per annum, on the reducing balance method. A full year’s depreciation is charged in the year of purchase and none in the year of disposal.

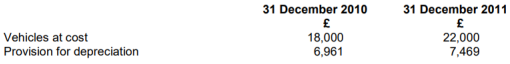

The balances in Yen’s accounts were as follows:

Question 2

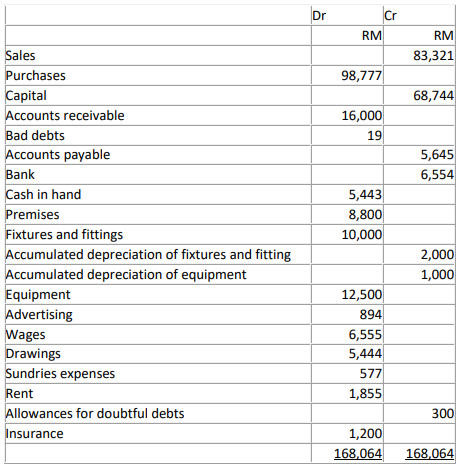

From the following trial balance of C Roddy, after her first year’s trading, you are asked to draw up a trading and profit and loss account for the year ended 30 June 20X4.

Question 3

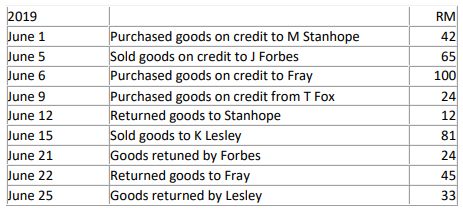

Mary, a sole trader, has the following transactions for the month of June 20X6.

Question 4

Robby Ltd has the following items in its statement of financial position on 30th November 2019; Van for

RM23,000, fixtures RM12,000, inventory RM12,000, cash in hand RM7,500, cash at bank RM10,000,

accounts receivable RM5,500, accounts payable RM10,000, capital RM 45,000, and loan RM15,000.

During the first week of December 2019

- Bought fixtures for RM2000 on credit

- Bought inventory RM1040 for cash

- Debtors paid RM1500 by cheque.

- Paid creditors RM300 by cheque and 300 cash.

- Introduce RM2160 into the business, RM 1400 cash, and RM760 by cheque.

- Take a loan of RM2000 from Roy in cash.

Get Help By Expert

Unlock the secrets of DBAF2003: Principles of Accounting with the assistance of Assignment Helper MY. Our team of dedicated professionals specializes in guiding students through the intricacies of accounting principles. From understanding accruals and deferrals to analyzing financial statements, we are committed to helping you excel in your accounting coursework.

Recent Solved Questions

- UGB371: In March 2020, Rapid Supply Electronics Components Ltd (RSEC) acquired Electronic BitsFast (EBF): managing and leading change Assignment, UOS, Malaysia

- You have to select the latest annual report of any one of listed companies in Malaysia: Financial Account and Reporting 2 Assignment, Uitm, Malaysia

- Discussion about Beryl Chocolate and Confectionery Sdn. Bhd.’s internal strengths (S): Principles of Marketing Assignment, UIU, Malaysia

- BBPM2103: Marketing Management I Assignment, OUM, Malaysia Explain the elements of the existing marketing mix and discuss how these elements are practiced in the selected firm

- MGMT20001: Organisational Behaviour Case Study, UOM, Malaysia What suggestions do you have for the president on how to coach Jack in developing a personal improvement plan

- CHE5884: Process modelling and optimization’s Case Study, MUM, Malaysia Calculate the hourly feed rate of the feedstock for the plant to produce the product assigned to your group

- FIT1048 Fundamentals of C++ Assignment, MUM, Malaysia You are asked to write a set of C++ classes that simulate the operation of an airline

- BMG307/03 Global Business Strategy Assignment: International Structure, Market Entry & Strategic Alliance Risk Analysis

- RQ1: Does the ride sourcing demand affect the traffic congestion in Malaysia?: Final year project A Research Paper, IIUM, Malaysia

- You plan to open a Malay restaurant specializing in serving Bandar Baru Bangi and Kajang traditional food: Production and Operation Management Assignment, OUM, Malaysia