UGB363: It is 31 January 2024 and the managers of Redsea are considering a change in the company’s dividend policy: Strategic Corporate Finance Assignment, USM, Malaysia

| University | Universiti Sains Malaysia (USM) |

| Subject | UGB363 Strategic Corporate Finance Assignment |

Part C

- It is 31 January 2024 and the managers of Redsea are considering a change in the company’s dividend policy. Earnings per share for 2023 for the company were 80p, and the finance director has said that he expects this to increase to 86p per share for 2024.

Get Solution of this Assessment. Hire Experts to solve this assignment for you Before Deadline.

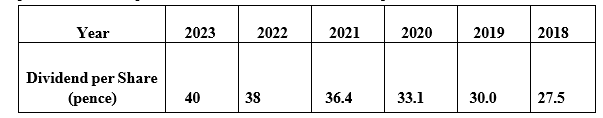

The increase in earnings per share is in line with market expectations of the company’s performance. The pattern of recent dividends, which are paid on 31 December is as follows:

The managing director has proposed that 70 per cent of earnings in 2024 and subsequent years should be retained for investment in new product development. It is expected that, if this proposal is accepted, the dividend growth rate will be 8.5 per cent. Redsea’s cost of capital is estimated to be 10 per cent.

Required:

Calculate the share price of Redsea in the following circumstances.

- The company decides not to change its current dividend (9 marks)

- The company decides to change its dividend policy as proposed by the managing director and announces the change to the market. (6 marks)

Required:

- Does the dividend policy adopted by a company impact upon the market value of that company? Academic findings within this area have provided conflicting evidence with two distinct theoretical schools of thought; one supporting dividend relevance and the other dividend irrelevance. Critically analyse and evaluate the differing theoretical viewpoints, ensuring the response is developed through incorporating relevant academic research that has been performed within this area.

In this section students should demonstrate knowledge, understanding, and an ability to critically evaluate and analyse the main dividend relevance and irrelevance theoretical viewpoints. The response should be developed through use of a wide range of relevant academic literature, referenced as per Harvard referencing requirements. The inclusion and ability to integrate real-life practical business examples, addressing whether differing companies adopt a dividend relevance or irrelevance standpoint would assist in developing the response in greater depth.

Get Help By Expert

Achieve success in your UGB363 Strategic Corporate Finance Assignment with our unbeatable support! As the cheapest assignment helper available, we specialize in providing expert assistance for students in Malaysia. Whether you need help with assignments or exams, our Online Exam Helper In Malaysia service is here to ensure your academic excellence. Trust our dedicated experts to guide you through the complexities of strategic corporate finance. Don't hesitate - invest in your academic journey today and let us help you succeed!

Recent Solved Questions

- MPU3193: Explain with examples how metaphysical concepts influence our beliefs about the relationship between man and God in religion: Philosophy and Current Issues Assignment 2, WOU, Malaysia

- HRM3183: Network Solutions, Inc. is a worldwide leader in hardware, software, and services essential to computer networking: Performance Management Case Study, UPTM, Malaysia

- International Business Assignment, UON, Malaysia The COVID-19 Pandemic has impacted International Business in a big way. Please discuss the main features of this

- UBA 1014: Artificial Intelligence (AI) in Decision-making, Assignment, Malaysia

- Contract Law Course Work, IIUM, Malaysia Our law of contract is widely seen as deficient in the sense that it is perceived to be hampered by the presence of an unnecessary

- BMG706 Assignment: Strategic Quality Change Implementation in Business Operations

- European Union Law Coursework, UOW, Malaysia On 9th November 2022, a newly established Spanish company called ‘’The Lovely Liquor Company’’ was transporting 500 bottles

- LEE 7112 Critical Issues in Law Enforcement Individual Final Assessment | SUC

- Database Systems Report, MMU, Malaysia You and your group of friends have recently decided to launch a startup company

- BBCE1023: Principles Of Macroeconomics Assignment, (TAR UMT), Malaysia