BBF30403 Assignment: Corporate Finance, Investment Analysis, and Key Financial Concepts Explained

| University | City University Malaysia (CUM) |

| Subject | BBF30403 Corporate Finance Assignment |

SECTION A : (25 MARKS)

1. Explain the importance of a stock market to a financial manager.

2. Fixed income securities

3. Primary security markets

4. Closed End Funds

5. Discuss the three main roles played by financial institutions in the corporate finance.

SECTION B :

ANSWER 3 OUT OF 5 QUESTIONS.

QUESTION 1

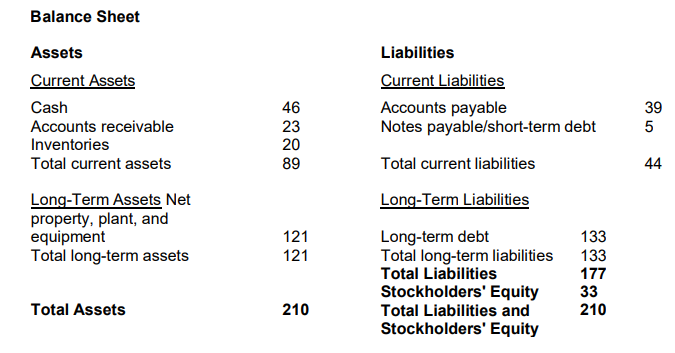

The below diagram shows a balance sheet for a certain company. All quantities shown are in millions of dollars. What is the company’s net working capital?

QUESTION 2

You are planning for retirement 34 years from now. You plan to invest RM4,200 per year for the first 7 years, RM6,900 per year for the next 11 years, and RM14,500 per year for the following 16 years (assume all cash flows occur at the end of each year). If you believe you will earn an effective annual rate of return of 9.7%, calculate your retirement investment will be worth in 34 years from now.

QUESTION 3

If Rashdan currently deposited RM2500 in his personal account, with 4% interest rate calculate his account balance at the end of 10 year using calculation compounded annually and compounded quarterly

QUESTION 4

Explain the issues of ethical practices among investors when considering various types of investments and support your answer with examples.

QUESTION 5

Describe in detail the FIVE (5) classifications of common stocks.

SECTION C :

ANSWER 3 OUT OF 5 QUESTIONS.

QUESTION 1

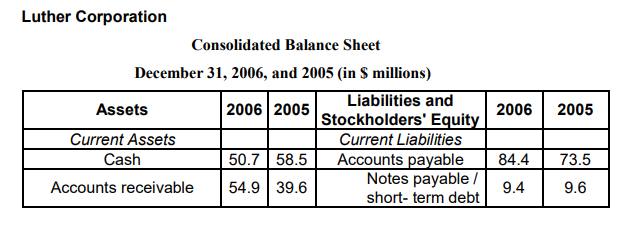

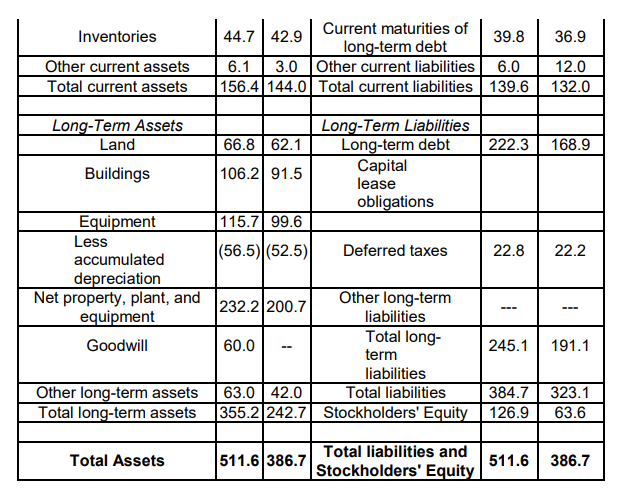

Refer to the balance sheet below, what is Luther’s net working capital in 2006?

QUESTION 2

You are considering buying a printing machine that will require an initial outlay of $54,200. The printing machine has an expected life of 5 years and will generate free cash flows to the company of $20,608 at the end of each year over its 5-year life. In addition to the $20,608 cash flow from operations during the fifth and final year, there will be an additional free cash inflow of $13,200 at the end of the fifth year associated with the salvage value of the printing machine, making the cash flow in year 5 equal to $33,808. Thus, the cash flows associated with this project are as follow:

| Cash Flow | |

| Initial Outlay | -$54,200 |

| Inflow year 1 | $20,608 |

| Inflow year 2 | $20,608 |

| Inflow year 3 | $20,608 |

| Inflow year 4 | $20,608 |

| Inflow year 5 | $33,808 |

Given a required rate of return of 15 percent, calculate the following

i. Payback period (4 marks)

ii. NPV (5 marks)

iii. PI (4 marks)

iv. Should this project be accepted? Justify your answer. (2 marks)

QUESTION 3

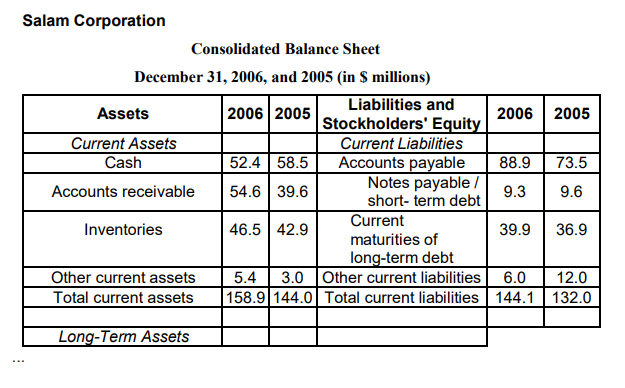

Refer to the balance sheet below, identify and explain the change in Salam’s quick ratio from 2005 to 2006.

Get Help By Expert

Need help with your BBF30403 Assignment Questions? Don't Worry! The best online assignment help services for Malaysian students are available here. Just write "do my assignment" and get your assignment before the deadline. Contact us now!

Recent Solved Questions

- CT0473M: Big Data Analytics & Technologies Assignment, APU, Malaysia Solid Protect Sdn. Bhd. is a leading company that utilizes state-of-the-art cybersecurity technology to safeguard

- BAIT2004: You are required to complete the tasks related to setting up local area networks and network configurations: Fundamentals of Computer Networks Assignment, TARC, Malaysia

- BBM208: Business Ethics Assignment, WOU, Malaysia Describe the details of the Theranos scandal. Discuss whether or not Elizabeth Holmes should be held responsible

- BNNS6243: Gastrointestinal Nursing Assignment, LUC, Malaysia Discuss the prevalence of colorectal cancer both globally and in Malaysia, and the contributing factors to its incidence

- Digital Electronics Assignment, SU, Malaysia Implement the counter using JK flip-flop, and assume that any unused states can be considered ‘don’t care states

- OUMH1203: English For Written Communication Assignment, OUM, Malaysia The Disadvantages of Social Media have Long been the Topic of Debate

- Research Methodology Assignment, UPM, Malaysia The manager of “Mee Segera Disukai Ramai” suspects that half of his 300 male and female workers are not very motivated

- BPA31803 Project Management Assignment Malaysia

- Business Ethics Essay, CU, Malaysia Having seen arguments concerning the various morally controversial issues, and the applications of the different ethical theories to them

- MPU3412: Discuss the following topic in the forum and submit proof of your participation in the online discussions: Community Service Assignment, OUM, Malaysia