BBM206: Accounting and Costing Assignment, WOU, Malaysia

| University | Wawasan Open University (WOU) |

| Subject | BBM206: Accounting and Costing |

Question 1

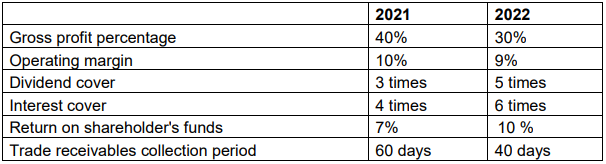

San Bhd manufactures and distributes glassware in Malaysia. The following

ratios are based on its financial statements for the years ended 31 December

2021 /2022.

- State the formula for each of the above ratios.

- Comment on each of the above ratios.

Question 2

Sim depreciates his machinery at a rate of 20% per annum on a reducing balance basis. He provides a full year’s depreciation in the year an asset is acquired, and no provision is made in the year of disposal.

On 1 November 2021, the cost of Sim’s machinery was RM140,900, and the net book value was RM94,570.

During the year to 31 October 2022, a machine that had cost RM35,000 and had been depreciated for four years was traded in for a new machine. The new machine cost RM50,000, and the trade-in value was RM14,000. On 31 October 2022, the balance of the cost of the new machine was still outstanding.

a. Calculate the profit or loss on the machine traded in.

b. Calculate the depreciation charge for machinery for the year 31 October 2022.

c. Show the following ledger accounts for the year:

i. Machinery at cost.

ii. Accumulated depreciation.

Get Help By Expert

Need help with your BBM206 Accounting and Costing Assignment? Our assignment helper Malaysia service is here for you! If you're thinking, "I need someone to do my assignment for me," or need expert help with accounting assignments, we've got you covered. With experienced professionals, 100% original content, and on-time delivery, we make sure you succeed in your coursework stress-free.

Recent Solved Questions

- Organizational Psychology Dissertation, APU, Malaysia One of the key elements in any organization is organizational commitment. Committed employees are less likely

- UBA1014 Group Assignment: Financial Recording,Financial Analysis Malaysia University of Science And Technology

- ABCC1103: Introduction to Communication Assignment, OUM, Malaysia Discuss how technology affects your lifestyle. Provide real examples in your discussion

- TAXATION Assignment, UTAR, Malaysia Your tax director has requested that you prepare a proposal to Cik Farra, addressing the following issues

- Probability Home Work, HWU, Malaysia The multiplication rule for dependent events is used since we are interested in the first player being a senior

- PGBM01: Relying only on accounting figures from Income Statement and Balance: Financial Management and Control Assignment, UOS, Malaysia

- Identify and discuss the reasons for Asda to conduct workforce planning: Human Resource Management Essay, UTM, Malaysia

- TSE2231: Software Engineering Fundamentals Home Work, MMU, Malaysia MMU has recently set up to provide state-of-the-art research facilities in Computer Science. Apart from students

- Propose and implement how you would embark data analysis journey for evidence-based: Advanced Data Analysis Assignment, TARC, Malaysia

- Dalam usaha memartabatkan profesion keguruan, sejauh manakah permuafakatan komuniti: Pengantar Pengajian Pendidikan Assignment, UUM, Malaysia