MPCF7113 – Final Assessment, CU, Malaysia – Corporate Finance, Case Study

| University | City University Malaysia (CUM) |

| Subject | MPCF7113: Corporate Finance |

Question 1:

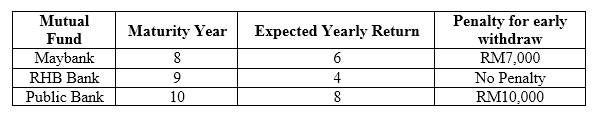

Harry’s father has just bought a lottery ticket and won RM50,000. He plans to invest his money in the mutual funds with the following information:

(a) What is the future amount available on the maturity year of each mutual fund? Critically evaluate if Harry’s father plan to withdraw all money at the 6th year, which mutual fund should he choose?

(b) If Harry’s father wish to pension in another 20 years with an expected pension amount of RM200,000. His current pension fund earning is 6% yearly. How much money shall he deposit today for the pension fund?

Nonetheless, Harry’s father only has RM60,000 as of today. Based on the answer of Question 1(a), critically evaluate the investment choice of Harry’s father to either invest in mutual fund or pension fund at the 6th year.

(C) UON bank is currently offering an annual interest rate of 3% compounded monthly for saving What is the future value at the 10th year if Harry’s father choose to save his RM50,000 in UON Bank. Critically evaluate the risks and return between mutual funds and saving accounts.

Question 2:

(a) Company A is hesitating to issue either cash or stock dividends to their shareholders. As the Chief Financial Officer (CFO) of the company, critically evaluate the reasons of issuing these two types of dividends based on the circumstance of the company in bull and bear

(b) With the emergence of COVID-19, most industries are experiencing a disruption in business that has caused a dramatic decrease in revenue and net profit.

As a finance manager of a Top30 public listed company, which operates in healthcare, automotive and F&B. Critically evaluate your cash flow management during COVID-19 to assist the company to sustain in pandemic.

Get Help By Expert

If you're a student tackling the MPCF7113: Corporate Finance case study , don’t struggle alone! Our online assignment helper in Malaysia is ready to lend a hand. Simply pay someone to do your assignment for me, and receive expert guidance that’s customized just for you. With our customized homework writing help, achieving a stellar grade in your MPCF7113 final assessment for 2024 is within your reach!

Recent Solved Questions

- Faculty of Pharmacy Assignment, AU, Malaysia Memory is defined as the faculty of encoding, storing, and retrieving information. The classical multi-store model

- HPGD1103: What impact do you think new technologies are having on the way curricula are developed and delivered?: Curriculum Development Assignment, Malaysia

- BBMP1103: A manufacturer sells a product at a price of RM150 per unit. The labour and material costs are RM20: Mathematics For Management Assignment, OUM, Malaysia

- JUS101: Teras Keusahawanan Assignment, USM, Malaysia Kursus keusahawanan bertujuan memberi pendedahan kepada pelajar mengenai bidang keusahawan dan

- LEA4173: Academic Research Assignment, SU, Malaysia Identify a topic or research area of interest in designing any software that can be used to solve users’ problems

- BAC305: Imbi Berhad bought 60% of Els Sdn Bhd on 1 January 2022. The noncontrolling interest: Company Accounting Reporting Assignment, WOU, Malaysia

- Principle of Marketing Report, UON, Malaysia Business knows that they cannot appeal to all buyers in their markets or at least not to all buyers in the same way

- CBWP2203 Assignment OUM : Sep 2024 – Web Programming

- COM62304: Organizational Communication Assignment, TU, Malaysia As a rising Communications Consultant, you are often invited to speak to entrepreneurs and managers

- Public relations Assignment, UTAR, Malaysia You need to find a news story in the media that discusses (explicitly or implicitly) the effects of public relations