Managerial Economic Assignment, UNMC, Malaysia What is the maximum amount you would pay for an asset that generates an income of $150,000 at the end of each

| University | University of Nottingham (UON) |

| Subject | Managerial Economic |

- What is the maximum amount you would pay for an asset that generates an income of $150,000 at the end of each year if the opportunity cost of using the fund is 9 percent?

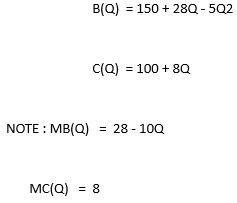

- Suppose that the total benefit and total cost from an activity are, respectively, given by the following equations:

A. Write out the equation for the net benefit.

B. What is the net benefit when q = 1? And when q = 5?

C. Write out the marginal net benefits.

D. What are the marginal net benefit when q= 1 and when q = 5?

E. What level q maximizes net benefit?

- A firm’s current profit is $550,000. These profits are expected to grow indefinitely at a constant rate of 5 percent. If the firm’s opportunity cost of funds is 8 percent, determine the value of the firm.

- Income elasticity of demand has various applications. Explain each application with the help of an example.

- Explain the nature and scope of managerial economics.

Get Help By Expert

Embarking on your Managerial Economic assignment can be challenging, but Assignment Helper MY is here to support you. Our team of skilled writers and economists can help you navigate through topics such as cost analysis, production optimization, and market dynamics. Trust us to provide you with well-researched and insightful solutions that demonstrate your understanding of managerial economics group assignments. You can also hire our experts for online Homework Help in Malaysia.

Recent Solved Questions

- FIT1047: User input (4 points) The next step is to implement a subroutine that reads a string, character by character: Introduction to computer systems, networks and security Assignment, MU, Malaysia

- A company, Photo Haven currently orders 15,000 hinges per month from E-Mach Manufacturing at MYR3.00 each: Business Mathematics Assignment, HU, Malaysia

- PGBM156: Strategic Management in an International Context Case Study, UOS, Malaysia: Critical analysis and evaluation of the strategies adopted by Multinational Corporations operating in an industry

- Critical Academic Reading Course Work, UiTM, Malaysia “The Advantages of Fast Fashion for Consumers” The issue discussed by the author demonstrates how the popularity

- Organizational Development Assignment: Tech Solutions Inc. Case Study on Engagement, Retention, and Inclusive Culture

- BBTS 2133 Assignment – Student Information Management System (SIMS)

- AI Deepfake Cybersecurity Assignment: Evaluating Security Risks and Detection Techniques for Safe Digital Environments

- Business Law Course Work, TU, Malaysia Lim agreed to sell to Ricky his house “Awesome Villa” on Tioman Island at the prevailing market value. Before the contract was signed

- Quantitative method for business Assignment, LU, Malaysia: The flagship state campuses are led by a Rector and smaller campuses are led by a Coordinator

- BMOM5203: Organization and Business Management Assignment, OUM, Malaysia Based on your reading of journal articles and books on leadership and your observation of the selected organization